Thinking about using Hyundai Finance to get a new car? It’s important to know your options and what could happen if you miss a payment. In this article, we’ll cover how Hyundai auto loans work, the risks of repossession, and how to manage your payments effectively. Let’s dive in.

Key Takeaways

- Hyundai faces many serious allegations of wrongful repossessions, notably involving servicemembers, highlighting the necessity for consumers to understand their rights under the Servicemembers Civil Relief Act.

- Managing car payments proactively, including setting up automatic payments and understanding grace periods, is vital to avoid delinquency and the risk of repossession.

- Repossession, whether voluntary or involuntary, has significant financial consequences, impacting credit scores and possibly leaving consumers with deficiency balances after vehicle sale.

Hyundai Auto Loans

Hyundai auto loans are designed specifically for individuals interested in purchasing Hyundai vehicles. These loans typically require a minimum FICO score of 575, making them accessible to many potential buyers. The application process is straightforward, involving an online form or a visit to a dealership where you provide the necessary documentation. One of the significant benefits of opting for a Hyundai auto loan is the competitive interest rates, which can lead to lower monthly payments and make car ownership more affordable.

Many lenders offer various financing options, and Hyundai is no different. Their auto loans provide flexible terms and conditions to suit different financial situations. Whether you’re looking to buy a new or used Hyundai, the financing options available can help you get behind the wheel without undue financial strain.

Hyundai is Guilty of Wrongful Repossessions

Hyundai faces allegations of wrongful repossessions. In May 2024, the Justice Department announced that Hyundai Capital America agreed to pay $333,941 to resolve allegations of violating the Servicemembers Civil Relief Act (SCRA) by illegally repossessing 26 vehicles owned by servicemembers. This federal law provides protections for servicemembers, preventing auto finance companies from repossessing their vehicles without a court order if they made at least one payment before entering military service.

One case in particular highlights the severity of these allegations. Despite informing Hyundai of her active military status, Hyundai repossessed her 2014 Hyundai Elantra without a court order, later selling it for $7,400 while she still owed $13,796 on the auto loan.

This incident, along with 25 other similar cases, resulted in Hyundai agreeing to pay $10,000 plus any lost equity to each affected servicemember, and a $74,941 payment to the United States. Such actions reflect a willful disregard for consumer rights by Hyundai.

Wrongful Repossession in Florida

Tampa, Florida consumer, Jaiwana Byrd, owned a 2022 Hyundai Kona that was financed through a loan from Hyundai Motor Finance. Ms. Byrd had lost her job causing her to fall behind on her car payments. Hyundai contracted with Primeritus Financial Services, Inc. to repossess Plaintiff’s vehicle due to the delinquent payments. Primeritus contracted with Howes Recovery LLC to carry out the repossession. So, on February 9, 2023, consumer/Byrd heard her car alarm sound. She went outside and observed a tow truck next to her vehicle. The tow operator told her he was there to repossess the vehicle. Byrd told the tow operator to stop the repossession as she was calling Hyundai right then to make a payment. To stop the repossession, consumer-Byrd sat inside her vehicle to make the payment. The tow operator started yelling at her that he needed to get the car and go. Byrd again advised the tow operator to stop the repossession because she was making a payment. The tow operator refused to stop the repossession, ultimately taking the car despite Byrd’s repeated objections. Byrd sued Hyundai, Primeritus, and Howes for, among other things, unlawful repossession under Fla. Stat. §§ 679.601 and 679.609, et seq. Hyundai and Primeritus filed a motion to dismiss the lawsuit arguing that Byrd’s claims fail because the claims were premised on an allegation that the tow operator “breached the peace,” but the facts, as alleged, Defendants’ contended, did not constitute a breach of the peace under Florida law. The trial court denied Hyundai’s Motion to Dismiss.

Florida courts apply the following two-prong test to determine whether “a breach of the peace has occurred within the meaning of the statute: ‘(1) whether there was entry by the creditor upon the debtor’s premises, and (2) whether the debtor or one acting in his behalf consented to the entry and repossession.'” Quest v. Barnett Bank of Pensacola, 397 So. 2d 1020, 1023 (Fla. 1st DCA 1981) (quoting Marine Midland Bank-Central v. Cote, 351 So.2d 750, 752 (Fla. 1st DCA 1977)). In the motion to dismiss, Defendants argue Plaintiff’s complaint fails because there is no allegation of entry by the creditor onto the debtor’s premises. Although more tenuous, a breach of peace can occur, even from a public street, where there is an objection by the vehicle owner to the repossession.

In general, the creditor may not enter the debtor’s home or garage without permission, but he can probably take a car from the debtor’s driveway without incurring liability. The debtor’s consent, freely given, legitimates any entry; conversely, the debtor’s physical objection bars repossession even from a public street. This crude two-factor formula of creditor entry and debtor response must, of course, be refined by at least a consideration of third-party response, the type of premises entered and possible creditor deceit in procuring consent.

Managing Your Hyundai Car Payments

Effectively managing your Hyundai car payments is crucial to avoid falling into delinquency and facing repossession. Hyundai offers various finance options, including deferred payment plans that allow borrowers to postpone their first payment under specific conditions. Staying current on your loan payments is essential not just for maintaining your vehicle but also for protecting your credit history and overall financial health.

Taking advantage of special limited-time annual percentage rates (APR) for qualified buyers through Hyundai Motor Finance can also help reduce the financial burden. These strategies can make a significant difference in managing your car payments and avoiding the pitfalls that lead to repossession.

Setting Up Automatic Payments

One effective way to manage your car payments is by setting up automatic payments. This ensures that your payments are always on time, preventing late payments and potential penalties. Many lenders offer discounts between 0.25% to 0.5% on interest rates for customers who opt for autopay, making it a financially savvy choice.

To set up automatic payments, you’ll need to provide your lender with accurate bank account information and authorization for automatic withdrawals. This not only streamlines the payment process but also helps maintain a positive credit rating by avoiding late fees and missed payments.

Some financial institutions also offer alerts to remind you before payments are processed, adding an extra layer of security and peace of mind.

Grace Periods and Late Fees

Understanding the grace periods and late fees stipulated in your car loan agreement is crucial. Many car finance agreements include a grace period during which you can make a late payment without incurring a penalty. This grace period provides some flexibility in managing your payments without immediate financial consequences.

However, late fees can vary significantly based on the lender’s policies, so it’s essential to be aware of your specific terms to avoid unexpected charges. Knowing these details can help you plan better and prevent any negative impacts on your financial situation.

What to Do If You Miss a Payment

Missing a car payment can be stressful, but it’s important to act quickly to mitigate the consequences. Typically, repossession is triggered after 90 days of default, which can lead to severe repercussions. Common forms of default include failing to make payments and not maintaining insurance on the vehicle.

If you miss a payment, the first step is to contact Hyundai Finance as soon as possible to discuss your situation and explore available options. Setting up automatic payments can help ensure you never miss a due date again, preventing any late fees or negative impacts on your credit.

Addressing the issue promptly can help you avoid repossession and maintain your financial stability.

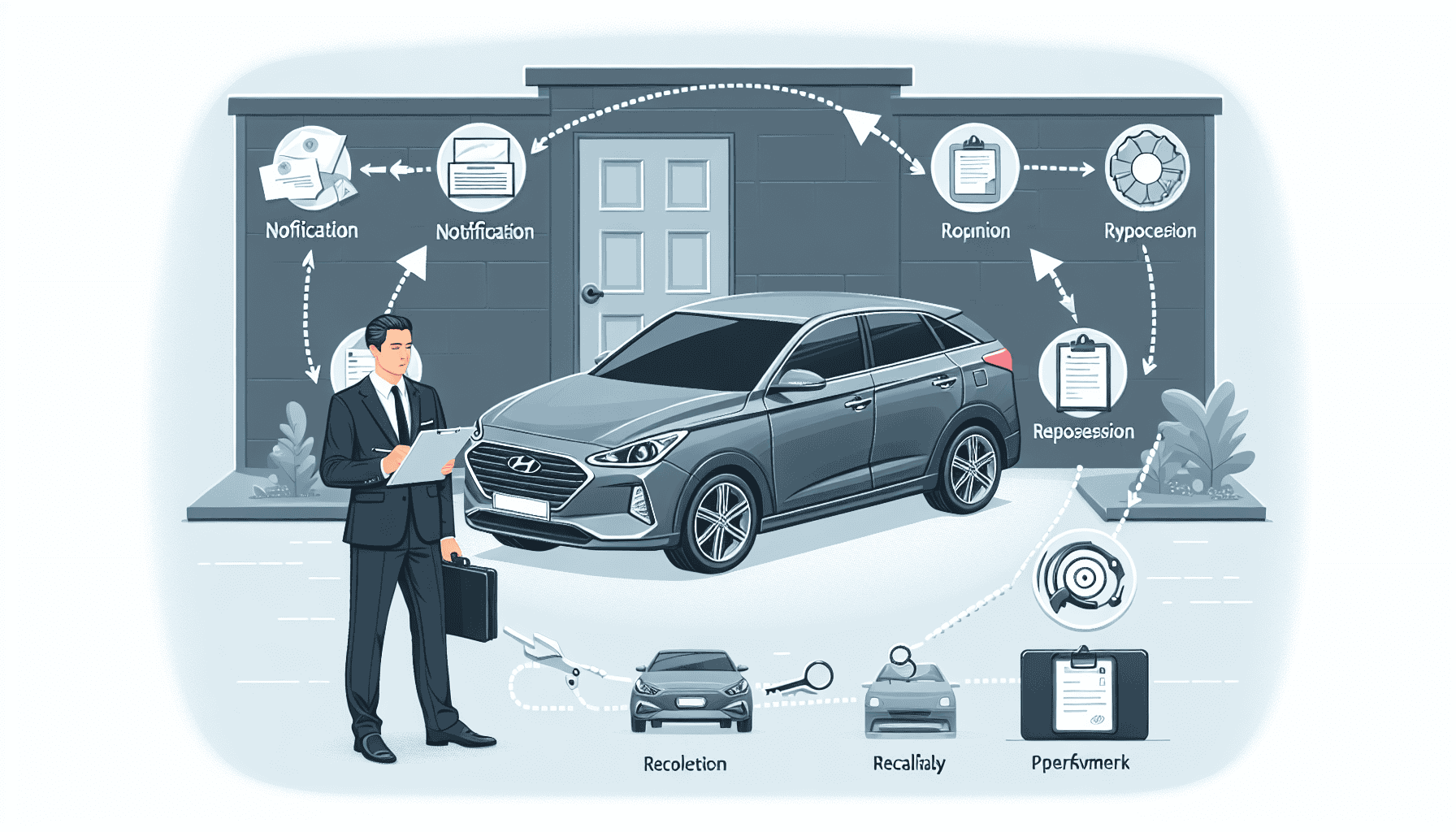

Understanding Hyundai’s Repossession Policies

Repossession can occur swiftly and with little warning, often leaving borrowers unprepared. The impact on your credit score can be significant, affecting your credit report for up to seven years. Understanding the difference between voluntary and involuntary repossession is crucial.

Voluntary repossession involves the borrower surrendering their vehicle to the lender, while involuntary repossession is performed by the lender without the borrower’s consent. Both types of repossession can incur costs, including fees for hiring repossession agents, towing, and storage, making it important to take proactive steps to avoid these consequences.

Voluntary Repossession

Voluntary repossession occurs when a borrower decides to return their vehicle to the lender as a solution to financial difficulties. This can be seen as a more responsible action compared to involuntary repossession, potentially mitigating some negative credit impacts. However, it can still negatively affect your credit score and may leave you with a deficiency balance.

To initiate a voluntary repossession, contact Hyundai Finance to inform them of your situation and discuss the return process. Remember, you may still owe a deficiency balance after the vehicle is sold, which can add to your financial burden if not addressed.

Involuntary Repossession

Involuntary repossession is the seizure of collateral by force, typically by a repossession agent. Once a Hyundai vehicle is repossessed, the lender attempts to sell it to recoup the unpaid debt. If self-help repossession is not allowed, the lender may need to seek a court order to retrieve the property.

This process can have severe consequences, including additional fees and a significant drop in your credit score. It’s crucial to understand these risks and take steps to avoid falling into default.

Handling Personal Property in a Repossessed Vehicle

When your vehicle is repossessed, you’re entitled to retrieve personal belongings found inside, excluding any permanent fixtures or customizations. The lender must return your personal items because they do not hold a legal interest in those belongings, only in the vehicle itself.

In certain jurisdictions, lenders are required to inform the vehicle owner about the personal items retrieved and the process for reclaiming them. State laws generally mandate that lenders notify you with an inventory of items left in the vehicle and provide an opportunity to reclaim them before selling the car.

Resolving Deficiency Balances

A deficiency balance occurs when the sale proceeds of a repossessed vehicle do not cover the remaining loan amount plus related costs. After repossession, if the vehicle is sold for less than what is owed on the loan, the remaining amount owed is considered a deficiency balance.

Lenders can pursue the collection of the deficiency balance unless state laws provide specific restrictions. It’s important to check state laws, as some states may limit the timeframe or methods lenders can use to collect deficiency balances.

Summary

In summary, managing your Hyundai car loan effectively is crucial to avoid the pitfalls of repossession. From understanding the loan terms and setting up automatic payments to knowing your rights in case of repossession, taking proactive steps can safeguard your financial health.

Remember, the key is to stay informed and act promptly if you face financial difficulties. By doing so, you can maintain control over your vehicle and your credit score.

Frequently Asked Questions

What should I do if I miss a Hyundai car payment?

If you miss a Hyundai car payment, it is essential to contact Hyundai Finance immediately to discuss your situation and explore available options. Additionally, consider setting up automatic payments to prevent future missed payments.

What is the difference between voluntary and involuntary repossession?

The key difference between voluntary and involuntary repossession is that voluntary repossession occurs when the borrower willingly returns the vehicle to the lender, whereas involuntary repossession is executed by the lender without the borrower’s consent.

How can I avoid late fees on my car payments?

To avoid late fees on your car payments, set up automatic payments and familiarize yourself with the grace period and late fee policies outlined in your loan agreement. Taking these steps ensures timely payments and peace of mind.

What happens to my personal belongings in a repossessed vehicle?

You are entitled to reclaim your personal belongings from a repossessed vehicle, except for permanent fixtures or customizations. Lenders are required to inform you of the procedure to retrieve these items.

How can a deficiency balance be resolved after repossession?

A deficiency balance after repossession can be resolved through options such as full payment, establishing a payment plan, negotiating a settlement, or leveraging state laws that may restrict collection methods. Additionally, filing for bankruptcy may discharge the deficiency along with other unsecured debts.